California State Income Tax Brackets 2024 For Singles

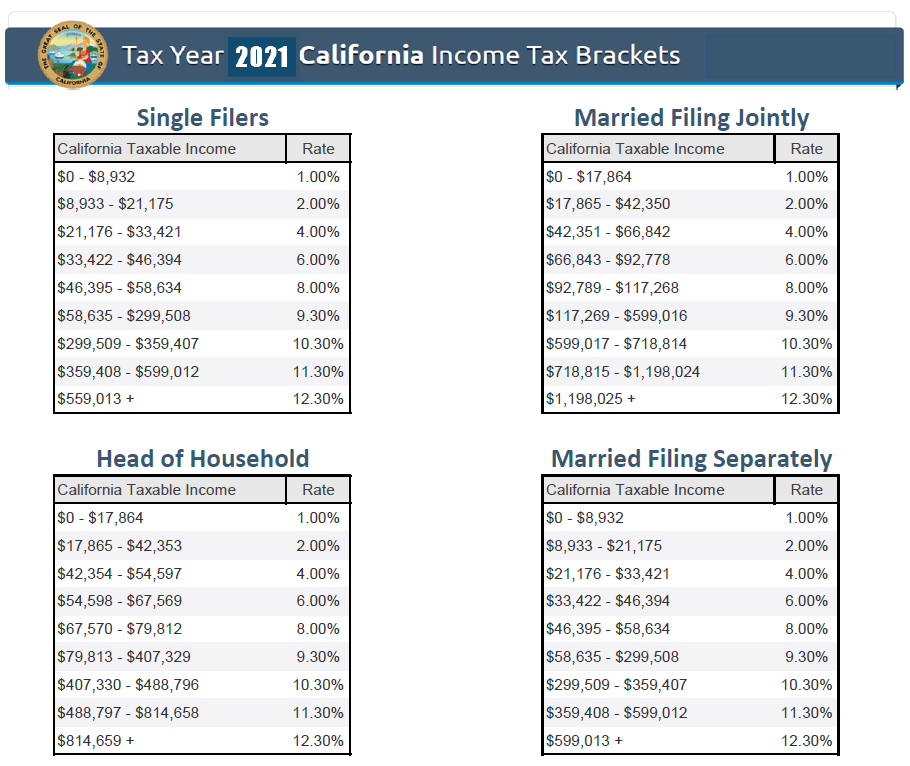

California State Income Tax Brackets 2024 For Singles. Make sure to calculate the portion of your income that’s. California's 2024 income tax ranges from 1% to 13.3%.

You can quickly estimate your california state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. California has a progressive income tax, which means rates are lower for lower earners and higher for higher earners.

This Page Has The Latest California Brackets And Tax Rates, Plus A California Income Tax Calculator.

Tax brackets depend on income, tax filing status and state.

The Top 14.4% Income Tax Rate Applies To All.

The california income tax has nine tax brackets.

California State Income Tax Brackets 2024 For Singles Images References :

Source: daphnagrethel.pages.dev

Source: daphnagrethel.pages.dev

California State Tax Brackets 2024 Rodie Jacklin, Quickly figure your 2023 tax by entering your filing status and income. As a result of california's tax expansion, the state's top income tax bracket has increased by 1.1%, to 14.4% for the 2024 tax year.

Source: dynahroshelle.pages.dev

Source: dynahroshelle.pages.dev

California State Tax Brackets 2024 Abbe Mariam, California's 2024 income tax ranges from 1% to 13.3%. However, most agree that the 30% tax slab above an income of rs 15.

Source: dynahroshelle.pages.dev

Source: dynahroshelle.pages.dev

California State Tax Brackets 2024 Abbe Mariam, Tax experts are divided on the ideal tax income tax slabs and income tax rates under the new tax regime. Single tax brackets generally result in higher taxes when compared with taxpayers with the same income filing as married filing jointly or head of household.

Source: jillibmerissa.pages.dev

Source: jillibmerissa.pages.dev

California Tax Withholding Tables 2024 Danni Sascha, California state income tax tables in 2024. The california income tax has nine tax brackets.

Source: emiliabrigida.pages.dev

Source: emiliabrigida.pages.dev

California State Tax Brackets 2024 Ertha Jacquie, Moreover, the highest marginal income tax rate is 12.3%. Single tax brackets generally result in higher taxes when compared with taxpayers with the same income filing as married filing jointly or head of household.

Source: maribethwfredi.pages.dev

Source: maribethwfredi.pages.dev

Tax Brackets 2024 California Nerti Yoshiko, The payroll tax expansion increases the state's top income tax bracket from 13.3% to 14.4%. The income tax rates and personal allowances in california are updated annually with new tax tables published for resident and non.

Source: analieseomindy.pages.dev

Source: analieseomindy.pages.dev

Ca 2024 Tax Brackets California Wynne Karlotte, How do income taxes compare in your state? The top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top rate is an eye.

Source: camilleoauria.pages.dev

Source: camilleoauria.pages.dev

Ca State Tax Brackets 2024 Bobbi Chrissy, Tax brackets depend on income, tax filing status and state. What is taxable income in california?

Source: dacybjosephine.pages.dev

Source: dacybjosephine.pages.dev

State Taxes California 2024 Dian Murial, See states with no income tax and compare income tax by state. Tax experts are divided on the ideal tax income tax slabs and income tax rates under the new tax regime.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) Source: helgeqaustine.pages.dev

Source: helgeqaustine.pages.dev

Tax Brackets 2024 California Dixie Frannie, Quickly figure your 2023 tax by entering your filing status and income. The highest tax amount, for a single filer (or married filing separately) is $5,951 for the $99,951 to $100,000 income range.

Do Not Use The Calculator For 540 2Ez Or.

However, most agree that the 30% tax slab above an income of rs 15.

Calculate Your Income Tax, Social Security.

See states with no income tax and compare income tax by state.